Thirty years ago an upheaval in the Pilbara iron ore industry prepared it for unforeseen growth in the following decades, yet at the time the prospects looked grim.

The three producers were afflicted with stoppages and obstructions rarely seen in Australian industry.

Some projects lost a fifth of their production through strikes and restrictions.

Companies built spare capacity into their projects so they could keep to delivery schedules for the main customers, Japanese steel mills.

Onsite union leaders virtually ran the industry, with the prospect, already being discussed by management, that projects would close.

There were stories that a project would grind to a halt because there was insufficient choice in ice cream flavours in the mess. Indeed, such a dispute led to a shutdown at the Robe River iron ore operation.

Shop stewards dictated much of the minutiae of running complex ventures. There was a policy, well concealed, in which companies avoided hiring British workers, particularly Scottish. The companies believed the migrants tended to become militant shop stewards.

Questionnaires and interviews were designed to seek them out, but of course with no official recognition of the policy.

The industry had suffered from “the shop stewards’ disease” almost since its launching in 1965.

A company executive explained that labour costs contributed only 15-20% of the sum needed to ship out a tonne of iron ore.

At the beginning, it was easier to yield to union demands than lose production. The ground rules, or lack thereof, were set for the next 20 years.

Some progress was made when the companies flew a group of union officials to Japan, to demonstrate the crucial nature of Pilbara ore to that country’s then booming steel industry.

They were impressed, but the message did not seem to get through to their members in the Pilbara.

Cliffs Robe River Iron Associates – which was absorbed later into Rio Tinto – was the smallest of the three ventures and by 1965 was being crippled by stoppages.

It is said that gatherings of union officials in Pilbara bars would discuss what new pretence could be conjured up to cause some further stoppage, and extract a new concession from management.

At Robe River, from January 1985 to July 1986 an average of 5293 hours of working time per month had been lost through strikes and work bans.

Not a single month had been free of industrial action. Robe suffered a drop of 30% in productive capacity between March and July 1986 as a result of bans, limitations and restrictive practices.

In July 1986 the company announced that most of its management was to be dismissed and all restrictive practices were to end.

Two weeks later all workers were dismissed but offered re-employment under conditions that the company laid down, but, unsurprisingly, these were rejected.

There were bitter demonstrations in the Pilbara – and indeed, Perth, with the union movement standing behind the Robe River workers.

Nevertheless about 250 people, roughly a fifth of the original workforce, maintained some sort of considerable production throughout the long periods when unionists were not working.

This did not include ship loading, but did demonstrate the kind of productivity improvements that could be achieved, albeit not under the stressful conditions that prevailed at that time.

It was months before the endless Industrial Relations Commission hearings and judgements were completed, but the upshot was that the widespread restrictive practices did end, and to everybody’s surprise control of the project reverted to management.

In six months of 1986 the company had produced almost 6.7 million tonnes of sinter fines, with more than 1230 wages employees.

This represented an annual production rate of little more than 13 million tonnes, an alarming performance given the labour and capital involved.

Expressed another way, that period produced 901 tonnes per month of ore, per worker.

In eight months of 1987 the picture was transformed, while the process of reform was still underway.

In that period the project produced more than 11.8 million tonnes of ore, with only 858 wages employees, a decline of nearly a third in the workforce.

Output per worker per month almost doubled to 1728 tonnes. Further increases in productivity followed.

There was residue of bitterness, particularly among the people who lost their jobs, and of course the executives who were discarded.

The other two iron ore miners, now known as BHP Billiton Iron Ore and Rio Tinto, quickly followed Robe River, though without the confrontation.

They gradually reduced their workforces and dismantled the labyrinthine sets of restrictions. There was no obligation to join unions, though some workers did.

Within a few years the total workforce in the iron ore industry dropped by half, yet production remained at pre-reform levels.

Automation in the industry and the increase in the scale of the equipment used make comparisons in productivity today difficult.

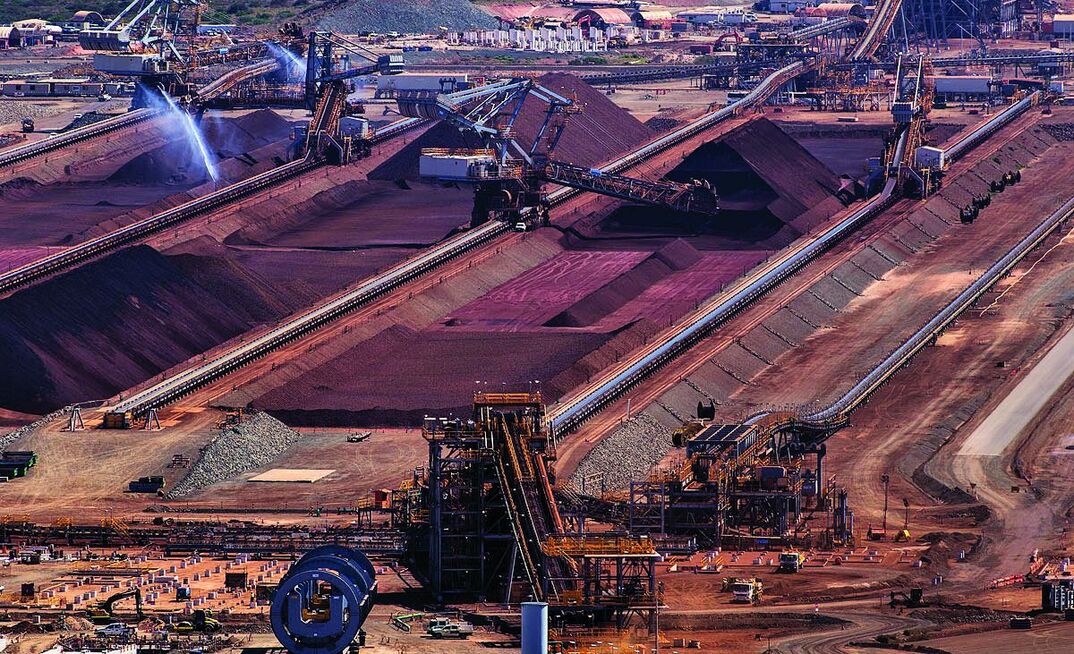

The increased efficiency in the industry helped in the spectacular increase in production, the proliferation of new minesites, the growth in the region’s ports and the emergence of other producers.

The heady years of the Chinese boom gave the miners a spectacular increase in cash flow, the emergence of the fly-in fly-out workforce.

There are signs that the union movement is seeking to again become a force in the Pilbara.